15th Anniversary of Bitcoin: A Peer-to-Peer Electronic Cash System!

Today marks the 15th anniversary of the day Satoshi Nakamoto published the white paper on Bitcoin detailing the novel open-source payment system that would enable any two self-interested parties to make online payments without needing to trust each other or a financial institution as a middleman.

Thanks to Satoshi Nakamoto, we now have an alternative to the fiat fractional reserve banking system that’s seen bailout after bailout with freshly printed cash diluting the savings of hard working people.

Satoshi’s white paper below was the published October 2008, at the heart of the Global Financial Crisis.

The Cave

Once upon a time, in a dimly lit cave deep beneath the earth, there lived a group of prisoners. They had been here for as long as they could remember, their necks chained in such a way that they could only see the cave wall in front of them. Behind them, a blazing fire raged, casting flickering shadows on the wall. This was their only reality.

The prisoners and slaves had no knowledge of the world outside the cave; they had been born here and knew nothing else. The shadows on the wall were their only source of entertainment and distraction. They would spend their days guessing at the shapes and movements of the objects that cast those shadows, never realizing that they were mere illusions.

Deep within the cave, the prisoners were not alone. A group of Federal Reserve bankers had made this cave their secret domain. They controlled the fire that cast the shadows, manipulating its intensity to create ever more convincing illusions. These bankers knew that as long as the prisoners remained ignorant of the world outside, they could maintain their power and control.

One day, a prisoner named Satoshi Nakamoto began to question the nature of their reality. He had always been curious, and the flickering shadows on the wall no longer satisfied his thirst for knowledge. He wondered what lay beyond the cave, what could cast such convincing shadows.

One fateful night, while the other prisoners were asleep, Satoshi managed to break free from his chains. He crept towards the source of the fire and, to his astonishment, saw that it was being fueled by stacks of US Dollars. The realization struck him like a lightning bolt—these bankers, with their control over the money supply, were the ones shaping the prisoners’ reality.

But Nakamoto’s journey was far from over. He knew that he needed to venture outside the cave to discover the truth. With great effort, he made his way towards the cave’s entrance, a narrow passage that led to the surface.

Emerging from the cave, Satoshi was blinded by the brilliance of the outside world. He shielded his eyes, tears streaming down his face. It was as if he had been reborn, seeing the world for the first time. He marveled at the vastness of the landscape, the beauty of nature, and the warmth of the sun—Bitcoin, as he came to understand it. It was the true source of illumination, far more powerful and liberating than the fire and US Dollars that had kept him and his fellow prisoners in ignorance.

Word of Satoshi Nakamoto’s discovery spread like wildfire, and soon, other prisoners followed him out of the cave. They, too, were awestruck by the world beyond, by the decentralized and transparent nature of Bitcoin. They learned to conduct transactions without intermediaries, to have control over their own financial destinies, and to break free from the shadows cast by the Federal Reserve bankers.

Back inside the cave, the bankers grew increasingly desperate as more prisoners escaped their illusion. They tried to manipulate the shadows even more, but their power was waning. The truth was out, and the prisoners and slaves were no longer fooled.

In time, the cave became a symbol of the old way of thinking, a place where ignorance was perpetuated by those in control. Outside, in the brilliant light of Bitcoin, the former prisoners built a new society based on freedom, accountability, and transparency. The shadows of the cave and the illusions of the US Dollar no longer held sway over their lives.

And so, the allegory of Plato’s Cave took on a new meaning in the age of bitcoin, where the light of knowledge and decentralized power illuminated the path to a brighter and more liberated future.

Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Misinformation is Real in Bitcoin & Crypto

Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

The amount of bad ideas and bogus information spouted off by mainstream financial media espousing misinformation onto the public is not in short supply these days. What is in short supply is actionable, clear, and data-driven ideas and information from reliable sources. As someone passionate about bitcoin and decentralized finance and the education around them, I feel it is my duty to dispel the false narratives that have surrounded bitcoin, crypto assets, and decentralized finance recently as well as be a good shepherd to teach those interested in learning the truth from someone who is an actual investor and practioneer with these assets, networks, and technologies.

As someone eagerly looking to consume content that can help me learn or understand more about topics that interest me, it is frustrating to see so much content that does the opposite. Please allow me to go line by line through an email that I got over the weekend that is so dumb and misguided it made me jump at the opportunity to write about everything they got wrong and why it’s silly to listen to the financial hucksters and “thought leaders” that have no idea what they are actually espousing knowledge on. Without further ado, please allow me to thoroughly eviscerate an email from the National Inflation Association, who’s “preparing Americans for hyperinflation,” with the subject line reading, “Tether Loses Its Peg on World’s Largest Crypto Exchange.”

“Tether Loses Its Peg on World’s Largest Crypto Exchange” 😱

Well let’s start with the title, I’ll say it was good clickbait because it got me to read the email I am now writing about in detail. Before even getting to read the first line on my smartphone, I flipped over to my TradingView account and typed in “USDT” to check the market prices at the time of me reading the email. Let me just say what I found just screamed intellectual dishonesty from the authors of the email because there is more to the story that they are bloviating over without discussing the factors at hand.

From my understanding and given the enhanced regulatory scrutiny on the exchange, Binance.US has no fiat rails to the traditional financial system after their partners have abandoned them. As a result, customers on the exchange cannot fund their accounts or withdraw using fiat dollars from/to their bank accounts. So, they are forced to use the stablecoin Tether (USDT) to trade as well as move funds to another exchange that still has its fiat rails if they desired to cash out completely into fiat.

Please continue reading to understand why there is no reason to panic as this NIA email suggests and why you’d probably be selling out to the “Big Boys” entering the space.

The first line of the email: “Tether (USDT) has lost its peg to USD on Binance the world’s largest exchange.”

Okay, let’s start with the fact they are talking the price of USDT on Binance.US that only serves residents and citizens of the United States and is a subsidiary of Binance that is the world’s largest exchange. As a citizen of the United States there exchanges like Coinbase, Gemini, and Kraken that have served American clients for nearly a decade that all have fiat rails and USD pairs for USDT and are holding their peg. The email fails to explain the external factors surrounding Binance.US’s parent exchange, Binance, that is under investigation by the Department of Justice (DoJ) as well as the Commodities Futures Exchange Commission (CFTC) and the Securities and Exchange Commission (SEC) with the recent threat of a temporary restraining order (TRO) that would have frozen funds for users on the platform. That might explain why they appear to be running to the exits with altcoins using USDT and why it’s trading <$1.

This bombastic claim is intellectually dishonest, lazy, and misleading.

The second line of the email: “It is currently priced at $0.9688 and dipped to a low on Friday of $0.9306.”

While that may be factual, it only traded at those levels on BinanceUS as opposed to Coinbase, for example, that upheld its peg there despite them also being under SEC scrutiny. At the other US-based exchanges such as Gemini and Kraken, the same story can be told about Tether holding its peg at or above $1. Given that they are using the same software to chart it as me, they could have easily looked at the markets for USDT on other exchanges and came to conclusion there is capital flight from Binance’s US-based subsidiary with worried investors pulling assets off the exchange.

This really does not matter because you can simply send USDT from Binance.US to Coinbase, for example, and cash out at or above the $1 peg at the time of this writing.

The third line of the email: “This is very troubling for the crypto market.”

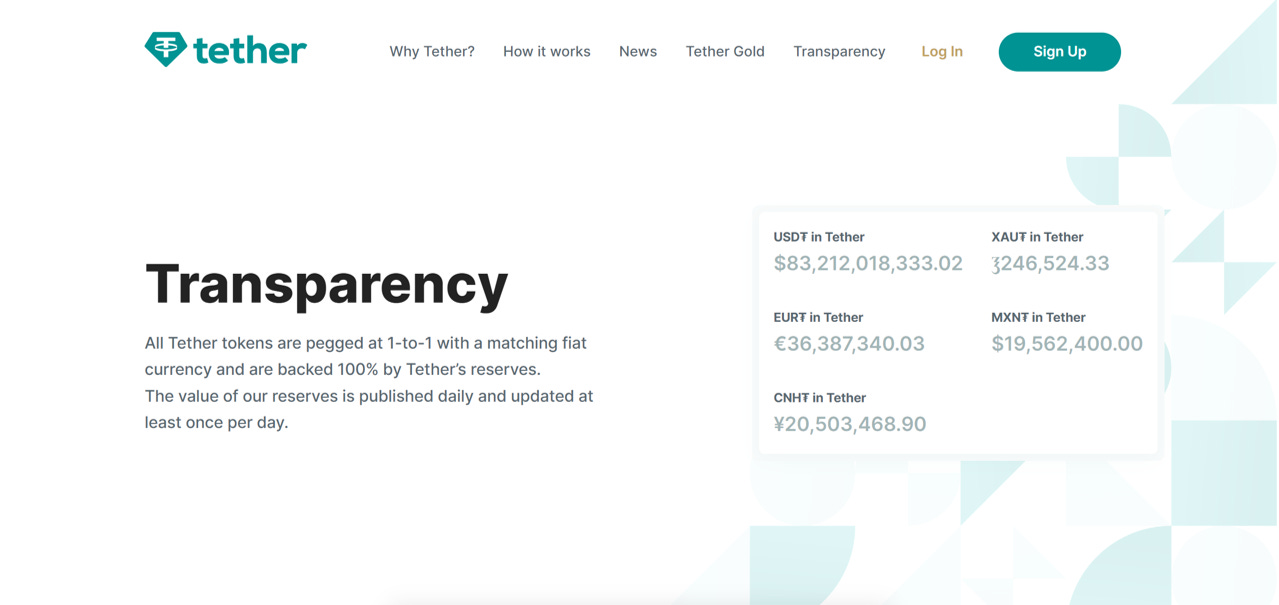

I can see how someone who already hook-line-and-sinkered themselves into this NIA email may think so, but this could not be further from the truth. Let’s just acknowledge the fact that USDT is a stablecoin redeemable at $1 by approved clients of Deltec Bank and Trust and it trades on secondary markets at the whim of traders on a given platform, and it claims and has shown for the most part to be fully reserved 1:1 with reserves in the banking system as well as holds US government debt and bitcoin to back its value. So, it is NOT troubling for the crypto market so long as they have the reserves that they claim to be holding as well as the bitcoin and bonds on their balance sheet do not plummet to $0 which seems wildly unlikely.

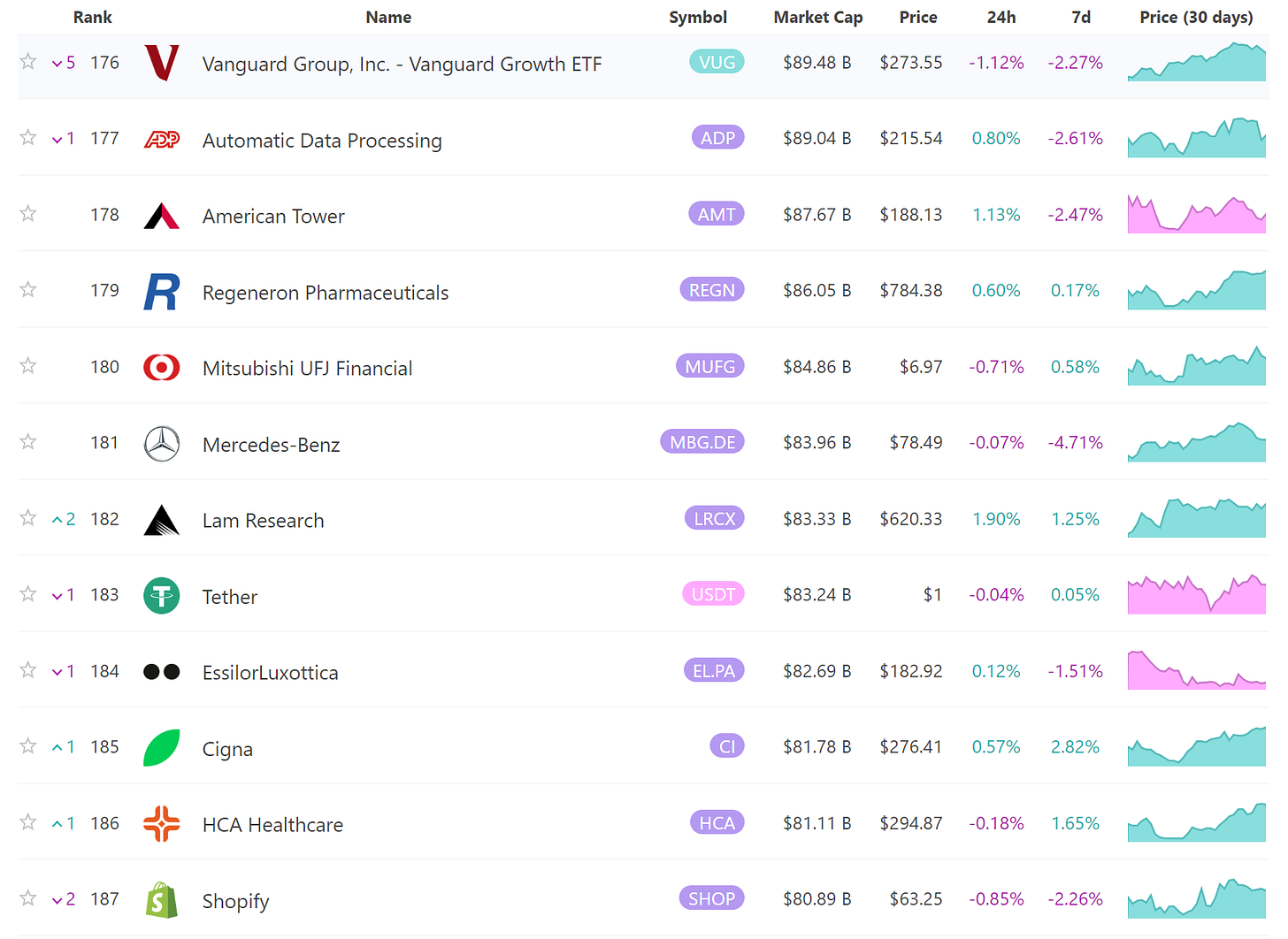

According to Q1 2023 filings, the net income for BlackRock was $1.16 billion as opposed to Tether that earned $1.48 billion over the same period. Interesting, right?

The forth line and next paragraph of the email: “Bitcoin was created by Satoshi Nakamoto (psuedonym for a bitcoin developer that got “disappeared” by the CIA) to be a peer-to-peer electronic cash system that would allow online payments to be sent directly from one party to another without going through a financial institution.”

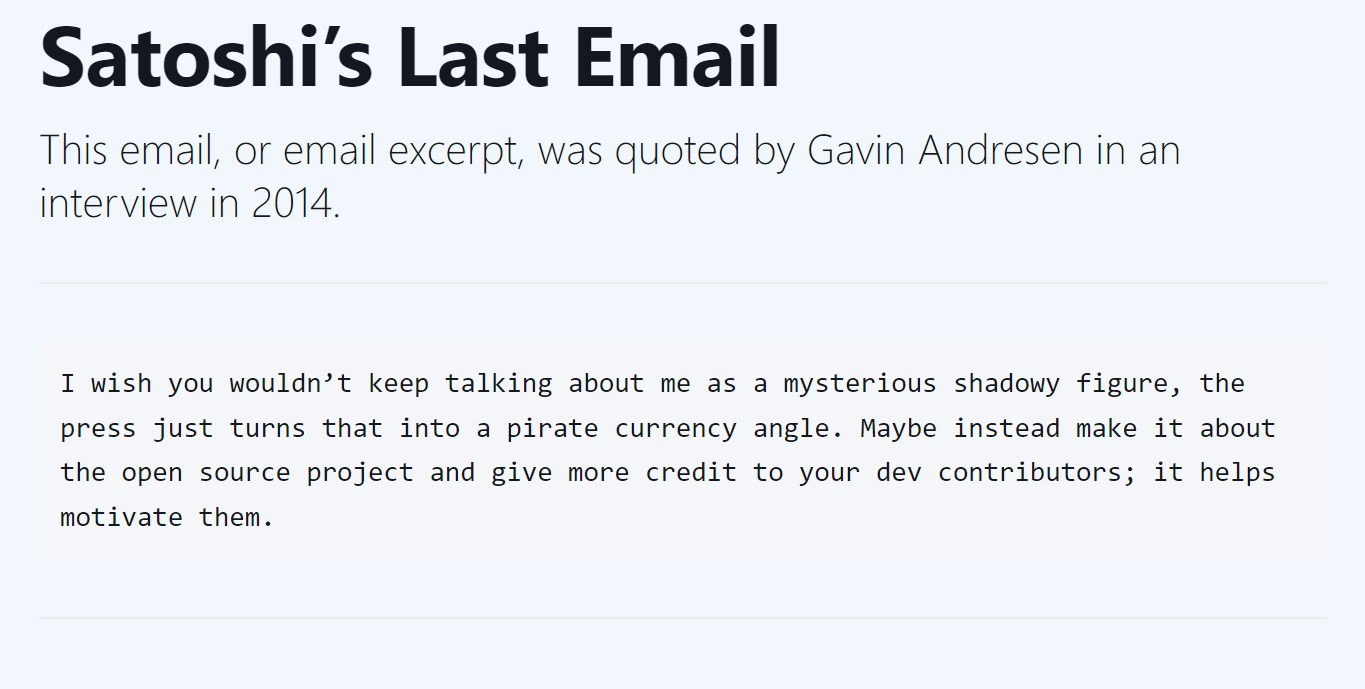

Wow, I would love to know where they pulled this anecdote from with zero evidence to support this claim about the CIA disappearing the developer who solved a 50 year computing problem and released the code to a group of open source developers for free. If they did disappear Satoshi Nakamoto, who contributed their own time and energy to start the project and who left to pursue other things after donating their coins, what did it accomplish because it is still running successfully today? Satoshi Nakamoto simply wanted to be anonymous and was never heard from again without elaborating why, so there would need to be some hard hitting information to back up such a conspiracy. Granted that Satoshi Nakamoto is nowhere to be found, he/they basically do not exist, which makes it impossible for any agency or any government to subpoena or summon them, so in other words “Who ya gonna call?” Everything else about Bitcoin allowing online payments without a financial institution though is correct.

Satoshi Nakamoto’s departure from bitcoin’s core development helped it grow organically into the decentralized, global, non-sovereign asset and network it is today.

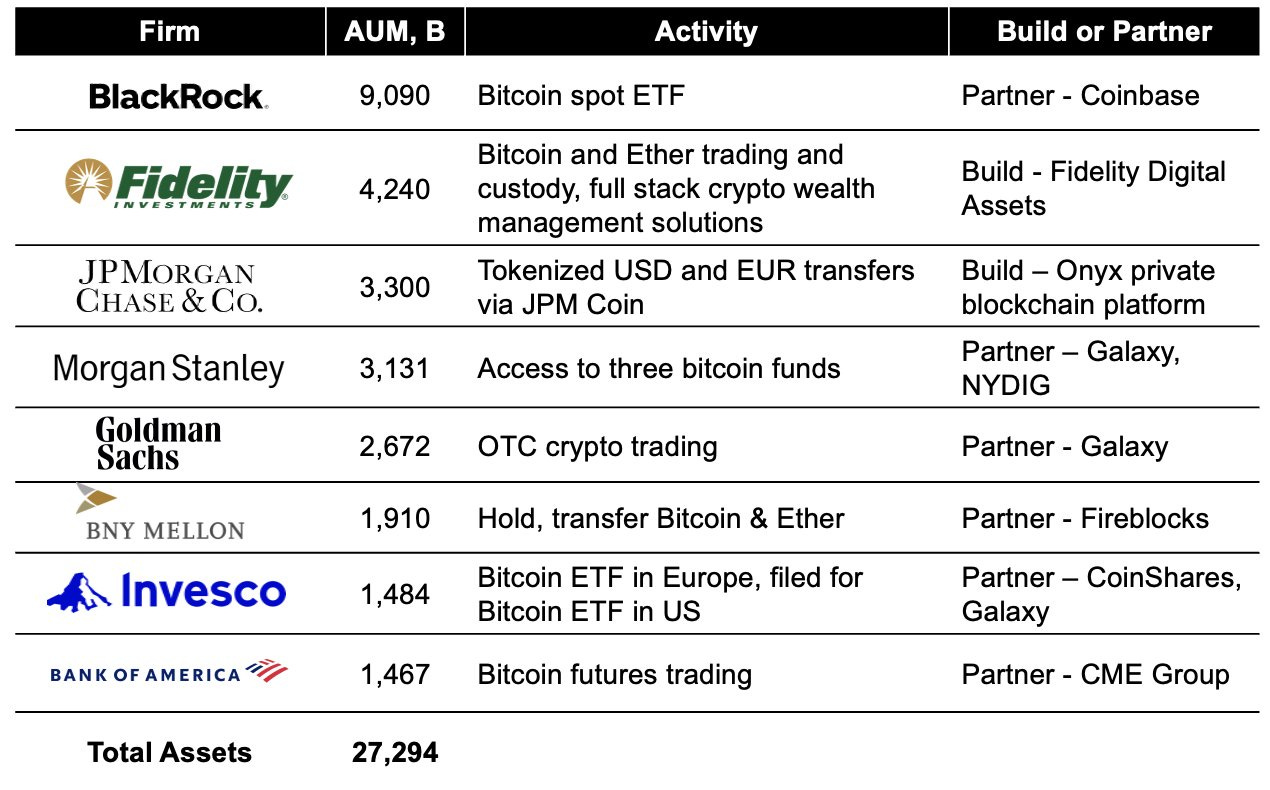

The fifth line and start of the second paragraph in the email: “How cringe is it to see Bitcoin’s most vocal supporters celebrating one of Wall Street’s largest and most corrupt institutions (BlackRock) filing with the SEC to create a Bitcoin ETF.”

If you’ve read my prior work on systemicbliss.com, I’ve been clear on my indifferent stance towards stablecoins and a Bitcoin ETF because stablecoins are digital IOU’s and substitutes for the world reserve currency (USD) that cannot generate much of a return (if at all) as an investor and an ETF is a paper substitute for BTC unless you can take custody of the private keys to the underlying bitcoin yourself. If they allow you to withdraw the bitcoin to a wallet you yourself control, then it is a perfectly fine product in my mind even if they are generating fees on the transactions. In that scenario as a dedicated bitcoiner, I see no problem with BlackRock as the largest asset manager in the world with ~$9.1 Trillion in assets under management applying for an ETF, especially when a flurry of applications for spot-based ETF’s to hold bitcoin came in the few days on the back of their announcement. For the record, the launch of BlackRock’s Gold ETF in 2004 started a nearly 7 year bull run for the price of gold!

The institutions arriving tells me two things: bitcoin has cleaned up its act as well as reputation for being used by criminals and mainstream adoption is not far away.

The sixth line of the email: “This defeats the purpose of Bitcoin in every way, but most Bitcoin cult members already realized long ago that nobody is adopting Bitcoin for use as electronic cash except for money launders and drug dealers.”

This may be the most idiotic sentence in the email because as I stated above it does not defeat the purpose of bitcoin if the trust structure permits the withdrawal of Trust property (bitcoin) in-kind minus any fees to a wallet where the shareholder has control of the private keys. As for the money laundering and drug dealer accusations that lazily gets tossed around as an argument against investing in bitcoin, I’d point to the U.S. Department of Treasury’s recent report, Illicit Finance Risk Assessment of Decentralized Finance, published in April this year. My favorite quote from that report is under the sixth section “Conclusion, Recommended Actions, and Posed Questions” concluding, “This report recognizes, however, that illicit activity is a subset of overall activity within the DeFi space and, at present, the DeFi space remains a minor portion of the overall virtual asset ecosystem. Moreover, money laundering, proliferation financing, and terrorist financing most commonly occur using fiat currency or other traditional assets as opposed to virtual assets.” In other words, there is a greater risk of money laundering and terrorist financing using the US Dollar and the traditional financial system than using bitcoin, crypto, or the decentralized financial system where every transaction in history is recorded on a public blockchain for all-time.

If you’re a criminal using crypto, it leaves a permanent paper trail. So, “cash is king!”

The seventh line of the email: “Their only choice is to market Bitcoin as a store of value by emphasizing its supply limit of 21 million, but Bitcoin’s supply is no more real than the U.S. debt ceiling.”

Never mind what I said above, this was the most insanely idiot argument against bitcoin because it can be debunked by simply auditing the public, open source code for the core protocol of the Bitcoin network. The bitcoin timechain contains every transaction broadcast over the network and shows the reward for a successful miner since the first genesis block, and it can be easily verified in the timechain that the reward for each block given to the successful Bitcoin miner for verifying transactions meeting the proper protocol rules is cut in half after every 210,000 blocks mined. This protocol cannot be changed easily because it would require more than 50 percent of the nodes and miners to change the code running on their machines, and as owners of bitcoin it would be against their own interest to dilute the bitcoin supply beyond 21 million. The supply limit is real because it is hard coded into the decentralized infrastructure that is distributed all over the world, plus it is observable through block explorers and the open source code. Do a little research and you’ll see this is total BS.

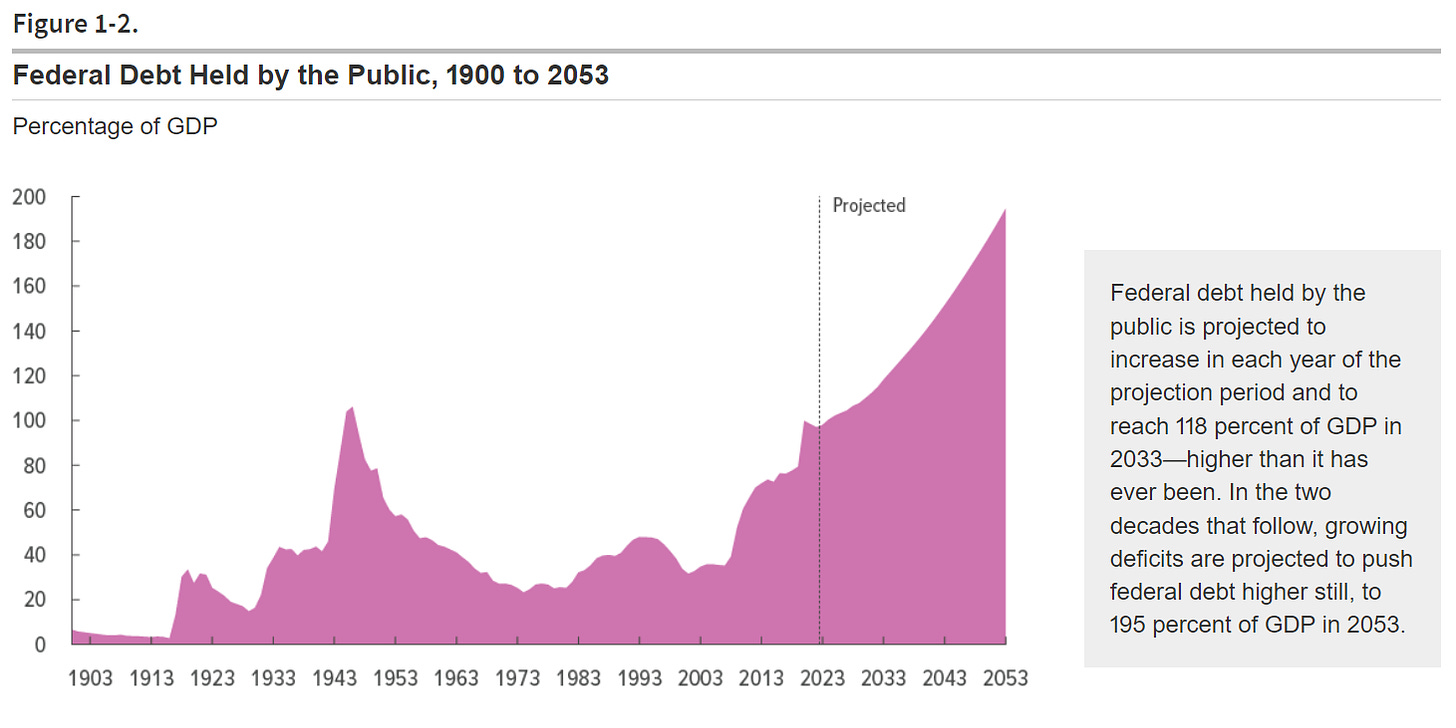

If you consider the path for US federal debt that is held by the public according to estimates from the Congressional Budget Office, it projects US debt levels to be 200% of GDP by 2051. The Fed would be wise to start buying bitcoin now before BlackRock, Citadel, Fidelity, and the rest of the banks beat them to the punch.

The eighth line and start of the third paragraph in the email: “Bitcoin mining companies consistently lose billions of dollars per year with the benefit of block rewards. As these block rewards continue to diminish, there will be less incentive to mine Bitcoin.”

Despite any decline in Bitcoin mining profitability over the past couple years, many mining companies have continued to build and increase production. For example on June 1st, CleanSpark announced it purchased 12,500 brand-new Antminer S19 XP units for $40.5 million working out at $23 per terrahash per second (TH/s) that is lower than the average market price. Given that the price of bitcoin around $30,200 according to CoinMarketCap at the time of this writing, it is rebounding from $21,028 a year ago after the TerraLuna collapse but still down -56% from its all-time-high of $68,790 on November 10, 2021. It does not matter if the block rewards continue to diminish because it is known and welcomed by the community since it upholds the 21 million supply limit, and the incentives will still be there to mine Bitcoin as long as demand and the price per coin continues rising with both institutions and mainstream adoption on the horizon to make that a self-fulfilling prophesy. Aside from this fear, uncertainty, and doubt (FUD), the bitcoin mining industry in Texas helps ERCOT keep renewable energy operational as well as balance their power gird with the massive and flexible loads of energy that bitcoin miners can offer to supply to their grid by powering down when it is very hot for economic incentives that help keeps their operations profitable even when they aren’t mining bitcoin.

According to ESG analyst and investor Daniel Batten, “All in all, roughly 52.4% of all Bitcoin mining relies on renewable energy for its power needs and the trend is expected to continue growing in the coming years as traditional energy sources become more and more expensive.” In the same CryptoSlate article Batten also says, “Meanwhile, roughly 43% of all energy used in Bitcoin mining is still generated via gas and coal. However, Batten noted that the electric vehicle industry still uses global gridmix, which generates 60% of its energy from fossil fuels.” Over the past couple of challenging years, bitcoin has dispelled the critics hurling FUD about its ESG footprint and now profitability in the face of a global digital gold rush for bitcoin with enormous amounts of fiat about to be printed out of thin air to pay off the mounting interest on government debt too.

Good luck finding another industry that is more “green” or uses more renewable energy in its mix than bitcoin mining, maybe that’s why BlackRock gave up fighting it!

The ninth line of the email: “If it is impossible for Bitcoin miners to make a profit during the best of market conditions in a massive bubble… imagine if their only source of income is Bitcoin transaction fees.”

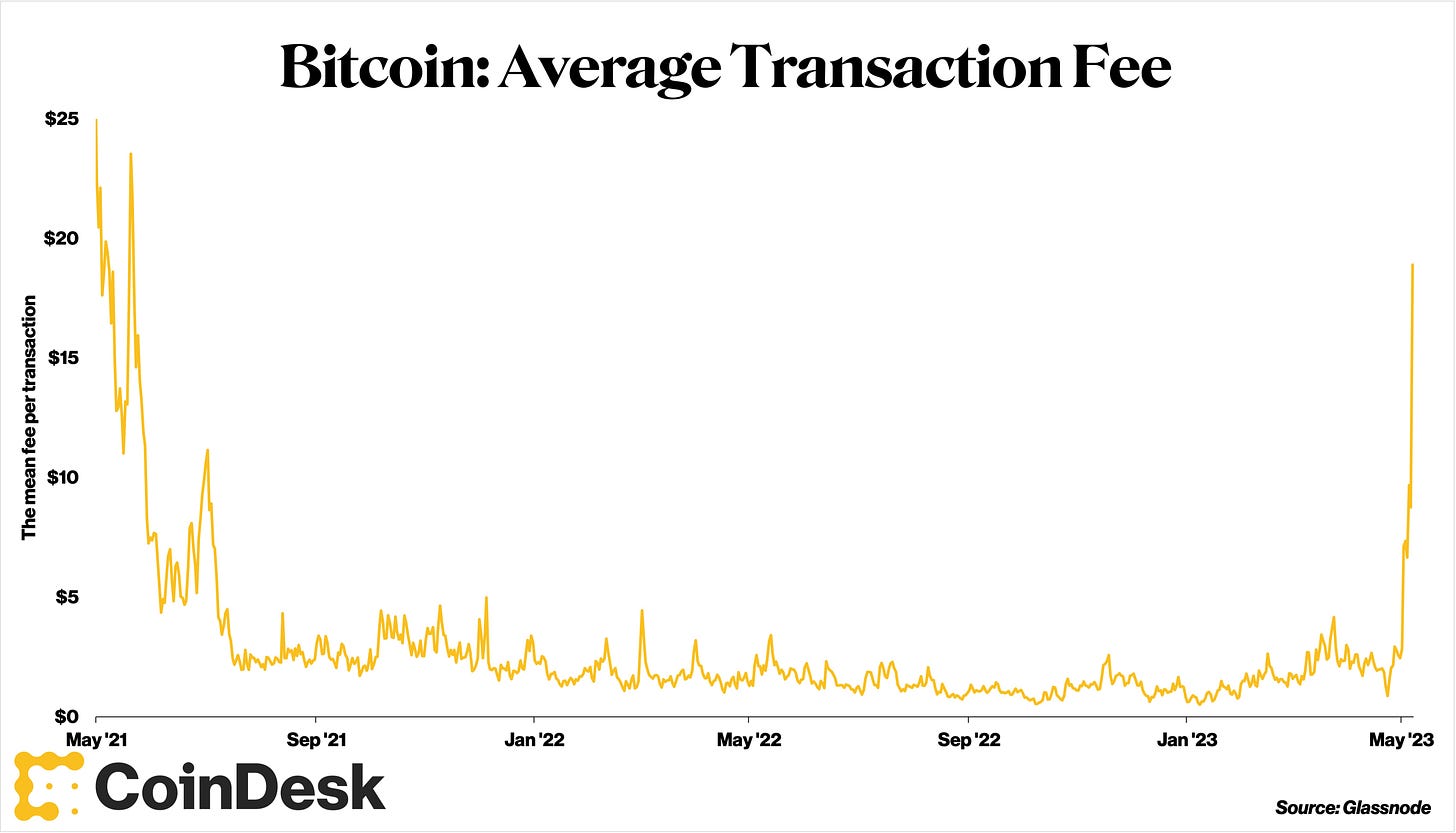

First off, over the last year with TerraLuna’s collapse taking down 3 Arrows Capital (3AC) with many centralized crypto lenders with it followed by the discovery of FTX’s complete fraudulent Mickey Mouse enterprise and embezzlement of customers funds was not exactly the “best of market conditions in a massive bubble.” Second, if you pay attention to bitcoin’s developments as closely as I do it would be clear to you that miners can and will easily survive on Bitcoin transaction fees because if a user wants to make a transaction bad enough they will incentivize the miners to prioritize it. It it simple economics and this spring with the emergence of bitcoin NFTs known as “ordinals” the network saw mined blocks on where fees exceeded Bitcoin’s block current reward of 6.25 BTC. According to a CoinDesk article this May, “For the first time since 2017, some bitcoin (BTC) miners are getting paid more to process transactions on the blockchain than they’re rewarded for creating new BTC, a potentially welcome development following the battering the industry has faced lately.” Simply another dishonest argument debunked again with a simple Google search, try harder NIA!

I’m starting to think that one of the “Big Boys” paid for this horrendous email to keep people from buying bitcoin while it’s still cheap before any applications get approved.

The tenth line of the email: “At some point down the road, Bitcoin miners will have no choice but to raise Bitcoin’s supply limit “for the good of the network” otherwise the Bitcoin network will collapse into a centralized cesspool… vulnerable to Quantum computer attacks that could wipe out all value stored on the network.”

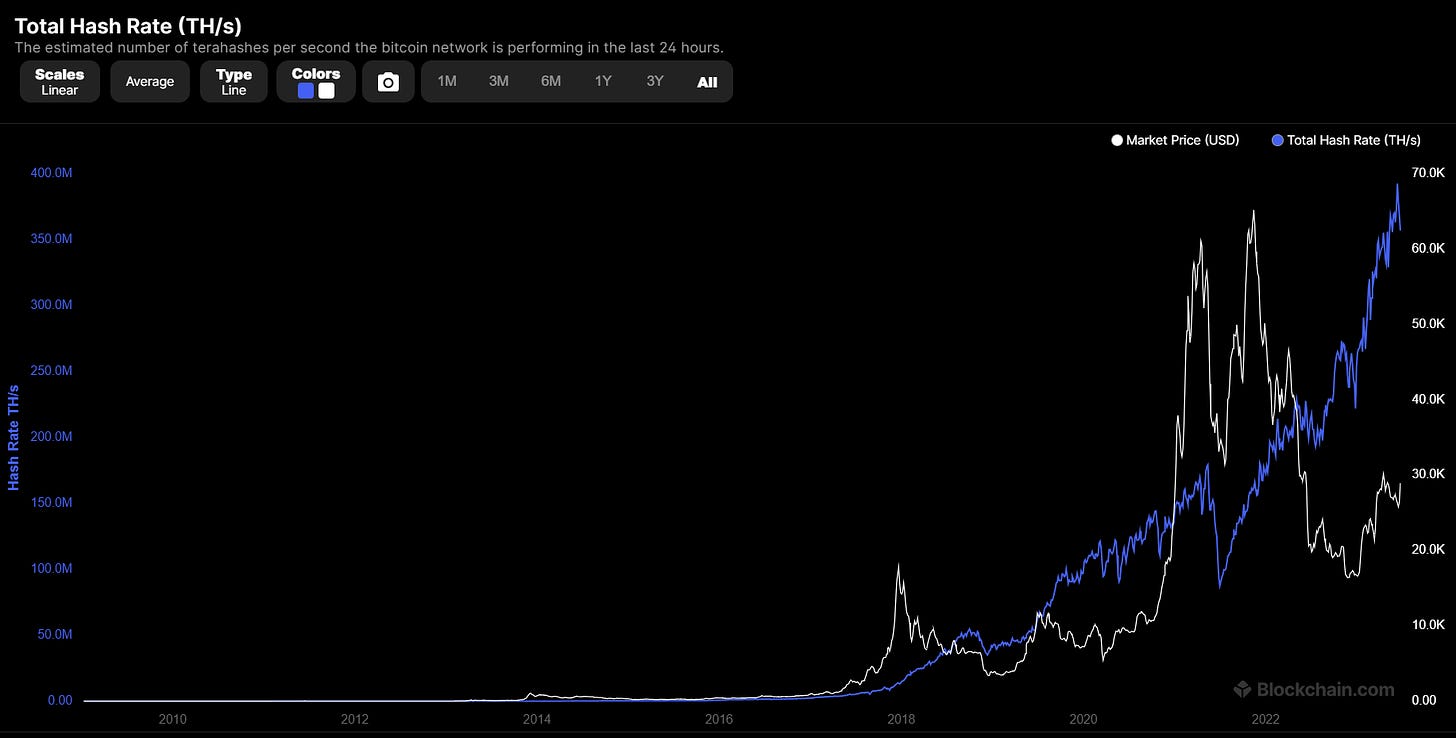

If they haven’t cast enough FUD yet, the above quote is a hilariously misguided assertion based off of no hard evidence or logic. Why would the bitcoin miners who hold a large amount of bitcoin on their balance sheets relative to their operations and overhead have “no choice” but to dilute their holdings and reduce the value of bitcoin in the process? The only way it could happen would be if somebody can successfully achieve a 51% attack over the consensus protocol, but given where the hash rate is currently it would cost more energy and time to do so than is physically possible even by any government with an army of supercomputers. Bitcoin’s increasing hash rate makes the protocol more secure because it would take more miners—and cost more in energy and time—to take over the network. Quantum computing is probably one of the biggest scams that does not work because it is not stable, which makes it a silly argument to use because in that same “doomsday” scenario it essentially would break the same encryption that would also crack into air traffic control towers, banking infrastructure, and many other things that would be far more catastrophic to society.

Quantum computing bringing down bitcoin and crypto is a fairy tale spun up by the intellectually dishonest and/or lazy folks that don’t do their homework or research.

The eleventh and final line of the email: “The gains that Crypto investors hope to achieve by speculating on worthless unbacked paper assets that still have 95%+ left to decline when Tether (USDT) goes bust in the upcoming months… are gains that they can really achieve in real life if they only think outside the box and do the opposite of what every single one of their friends and favorite “influencers” on social media are telling them to do.”

It is hard to take this seriously because as I have stated Tether as an asset really has no problem so long as the total market for USDT is backed 1:1 at least to the equivalent amount held in reserve at the bank and collateral on their company balance sheet. Despite the everlasting FUD that people love to hurl at USDT, it was more profitable than BlackRock in the first quarter this year. According to CoinGecko data on June 15, Tether’s stablecoin (USDT) hit an all-time high in market capitalization over $83.5 billion propelling it up into the top 200 market cap’s of global brands and companies. Keep in mind, the NIA that loves gold and BlackRock’s iShares Gold Trust (IAU) is up 5.17% over the past year barely keeping up with headline inflation (CPI) that’s up 4.13% while bitcoin (BTC) is up 46.36% over the same time period. Rather than going with the intellectually dishonest and lazy investment of choice of gold that historically is the least “outside of the box” with central banks holding the largest portion of the gold supply with money printers in their basements and can print fiat out of thin air and distribute it to banks and financial institutions to suppress the gold price in order to maintain the illusion of “stable” prices after abandoning their gold standard for fiat.

BlackRock and the Federal Reserve hold zero bitcoin, and you can still beat them to it!

Enough with that ridiculous email, here are some final thoughts…

The United States is squandering an early lead on bitcoin and crypto mostly because of MIT “wunderkind,” Sam Bankman-Fried (SBF). He was one of Joe Biden’s top donors behind only Michael Bloomberg, and his parents were esteemed law professors at Stanford with his mother co-founding Mind the Gap a political organization that funnels a lot of campaign money to the Democratic party and his father had helped tax legislation for Elizabeth Warren, who happens to be the chair of the Senate’s banking committee that was formally established as the “Committee on Banking and Currency” in 1913, when Senator Robert L. Owen of Oklahoma sponsored the Federal Reserve Act. Elizabeth Warren probably singlehandedly helped spark SVB’s bankrun.

Not to mention the father of Caroline Ellison (SBF’s onetime girlfriend who as co-CEO ran SBF’s hedge fund Alameda Research the sister fund to the FTX that SBF also co-founded), Glenn Ellison, who was once Gary Gensler’s boss when he was a professor at MIT teaching blockchain courses where Gensler also worked in their Media Lab with funding coming from Bill Gates and Leon Black as well as Jeffrey Epstein who was motivating them to do so. Gensler during his time at MIT advised on the Digital Currency Initiative (specifically, Project Hamilton that is “building a hypothetical central bank digital currency” and partnered with the Boston Federal Reserve) as well as the Ethics and Governance of AI project. Sounds fishy, doesn’t it?

I can’t help but think this is a coordinated an attack on bitcoin and crypto to discredit their success in order to try to centralize and regulate them that would defeat their purpose as decentralized, permission-less, non-sovereign assets/networks. Then, after the market craters from the destruction the Fed caused, the regulators roll out plans for faster payments and transactions with FedNow as well as talk about how a central bank digital currency (CBDC) could work and the role of stablecoins as money. The timing and structure seems too perfect to be a natural progression rather than a plan orchestrated by the highest levels of finance and intelligence. The Enron lawyer, John J. Ray III tasked with recovering funds in FTX’s bankruptcy and doing forensic accounting to track where the funds went, said that the individuals involved may have been “compromised.” Suggesting FTX’s bad actors were acting against their own will or they’d been coerced into criminal activities by a clandestine intelligence agency.

Politicians on both sides of the aisle accepted campaign donations that were funds probably stolen from FTX customers ahead of the midterm elections, and now they are going after bitcoin and crypto. By using the US regulatory regime, they are effectively scaring capital offshore and into international solutions such as Tether versus US-based assets like Circle’s stablecoin, USDC, that’s fully onshore with its reserves (once upon a time) sitting at Silicon Valley Bank that is a US-domiciled bank in the traditional financial system with the Federal Reserve as its regulator. Circle holding short-term US Treasury bills on its balance sheet helps keep itself operating and profitable and transparently. Plus, what’s not to like about Circle helping fund the US government by buying debt that the foreign banks and sovereign wealth funds have been net sellers of for years? Perhaps, this is why Jerome Powell may have changed his tone towards stablecoins in his recent testimony in front of the Senate.

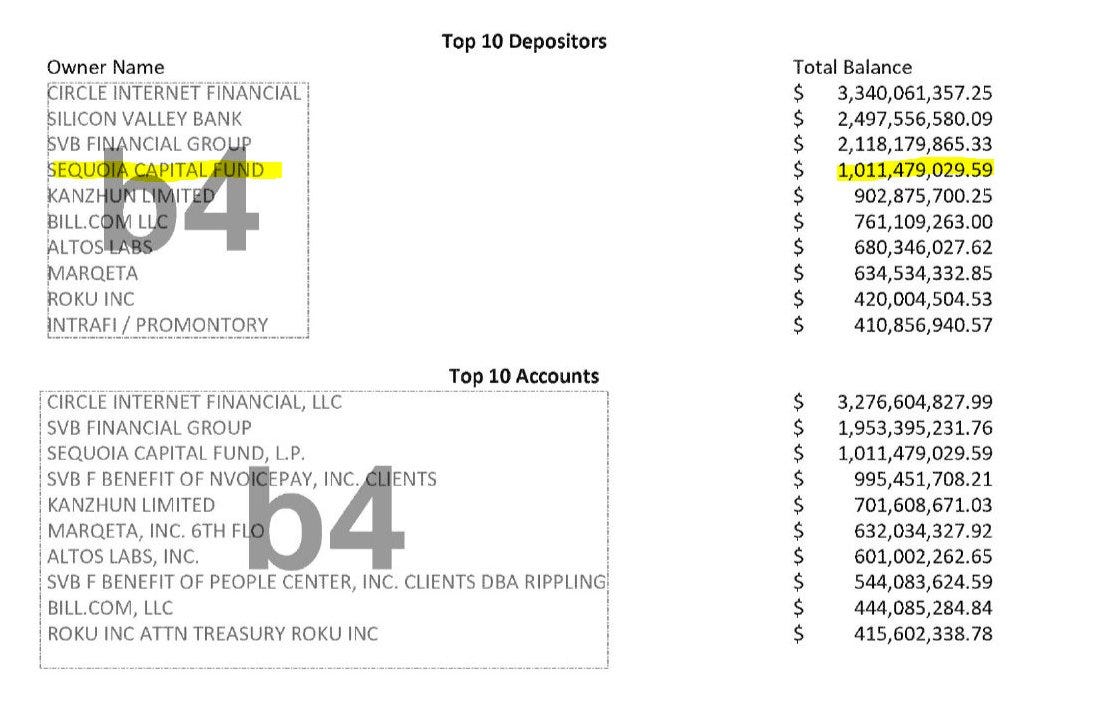

According to Joe Weisenthal (@TheStalwart) on Twitter last Friday, “The FDIC accidentally posted an un-redacted document showing that the big VC firm Sequoia had $1 billion on deposit at SVB when it collapsed,” with an image of the document (see above) showing top 10 customer balances at the failed bank along with a link to the Bloomberg article titeled, “The Big Names That Got Backstop for Billions in Uninsured SVB Deposits.” Circle, the issuer of USDC, was the largest depositor at Silicon Valley Bank as well as the bank’s largest account. The FDIC taking over the bank made the decision with the Federal Reserve and US Treasury to make deposits whole even over the $250,000 limit because Yellen has the authority to deem a banking institution systemic guaranteeing all deposits with the help of the Federal Reserve.

It is mind blowing that the FDIC “mistakenly” released a complete version of the document showing the US government spent $12,777,003,600.48 to bailout the top 10 wealthiest uninsured depositors amid a banking crisis. Even more confounding is the three large banks that blew up this year were not even on the FDIC’s problem bank list! If you examine the Federal Reserve’s emergency loans including their discount window, the Bank Term Funding Program (BTFP), and FDIC loans since March, they have altogether ballooned into the beginning of May and have cooled a bit since then. The US Money Supply (M2) increased into May also for the first time since last July, ending its record streak of 9 consecutive monthly declines. Inflation rising again soon?

What is interesting is that Janet Yellen, as Secretary of the US Treasury Department, has to be aware that backstopping all bank deposits increases moral hazard and she must know it also solidifies the view that the US government stands behind the entire deposit base of the US banking system, which is massively inflationary at a time when inflation is the number one concern for Americans. Oddly the CEO of SVB was also a board member of the Federal Reserve Bank of San Francisco, which is one of the twelve “bankers’ banks” that make up the Federal Reserve System. Surely, he should have been aware of the risks massive uninsured deposits posed to the bank as well as the banking system before it collapsed this March following the bank run on deposits that posed liquidity issues for the bank and began to call into question its solvency.

I’ve got to say the Federal Reserve and FDIC bailing out Circle was not on my bingo card this year because that means our government more or less backstopped the bitcoin and crypto ecosystem as well. That alone should be pretty monumental. As a subscriber to Capitalism and fair as well as free markets, it still kind of rubs me the wrong way that the traditional financial system is under a socialist model that privatizes gains for the banks but socializes losses through currency devaluation from any money printing and/or the taxpayers funding the bail out packages. But, I guess every dog has its day, and bitcoin and crypto had theirs recently whether or not most people even realize that ecosystem also got bailed out in the recent banking crisis too.

Although I am grateful they bailed out the SVB depositors and spared the bitcoin and crypto ecosystem from further disarray by keeping USDC’s reserves backstopped, this is a real headscratcher because the current regulatory regime has pushed capital into an offshore product like Tether that has shadier founders and partners than Circle who is compliant, fully regulated, and onshore with reserves sitting transparently in the traditional financial system where the Federal Reserve System has oversight. Deltec Bank and Trust is the banking partner of Tether that holds its reserves, but it is located in Nassau in the Bahamas that is in an entirely different jurisdiction with drastically different regulations over the reporting and supervision on their reserves. I just don’t get it, why would you help save an industry only to push it offshore again? Fishy.

All this fresh liquidity in the system is primarily going to money market funds (MMFs) and short-term US Treasury bills (T-Bills) with maturities less than a year that may be compounding the problem for the banks trying to compete with MMFs and T-Bills because they need to keep deposits from fleeing by offering higher interest rates too. Jerome Powell as chairman of the Fed and Janet Yellen have to understand that inflation is looking to kick back up in August and raising interest rates further will only exacerbate the problems in the banking sector. I will be writing about this more.

We’ve seen inflation coming down year-over-year but only because the rate of change has slowed down from 40-year highs last year, not because consumer prices have stopped inflating. If you take the monthly average of 0.4% on inflation since the beginning of 2020 and plug it in for the rest of the year CPI will start going back up in August, which is completely contrary to the narrative of the Federal Reserve raising interest rates to reduce inflation. So, at this point, it doesn’t matter which way the Fed goes with interest rates because it means that there will be more inflation regardless.

If they choose to hike rates further, it means more pain for the banking sector and possibly a crisis in regional banks due to the commercial real estate sector dragging them down. If they cut, it signals to investors that cheaper credit is back on the menu so they can stop buying short-term debt and start playing in the markets again. In either scenario, investors will want to take some of those profits in US T-Bills or Money Market Funds and redeploy into equities and technology with higher betas.

Which gets me to thinking, it’s probably a really good time to load up on bitcoin as well as other hard and risk assets to keep up with that money printer and before BlackRock and Fidelity can get their hands on some! I see the bitcoin price being a function of US Dollar liquidity as well as technology, and if we see increased liquidity and continued demand for technology to rise this year into the rest of the decade, we could be currently in the trough before a multi-year and possibly decade-long bull run.

“It was going up and — even though I didn’t think much of it — I just couldn’t stand the fact that it was going up and I didn’t own it. I never owned it from like $50 to $17,000, I felt like a moron…

The problem was Jay Powell and the world’s central bankers going nuts and making fiat money even more questionable than it already has been when I used to own gold…

I got a call from Paul Tudor Jones and he says, ‘Do you know that when Bitcoin went from $17k to $3k that 86% of the people that owned it at $17,000, never sold it?’ So here’s something with a finite supply and 86% of the owners are religious zealots.”

— Stanley Druckenmiller, 2021

CHOOSE YOUR FIGHTER!

(A) US Dollar or “USD”

- unlimited in supply

- not backed by anything

- centrally controlled, unable to audit

- owners are mostly central banks and financial institutions

vs.

(B) Bitcoin or “BTC”

- fixed supply of 21 million BTC

- backed by computing power & energy

- no one can centrally control its issuance

- owners are “religious zealots” that refuse to sell

vs.

(C) Gold or “IAU”

- unknown supply on and off earth

- backed by central banks & asset managers

- heavily centralized and easily manipulated through paper issuance

- owners are central banks mostly followed by old people that listen to infomercials

Thanks for reading systemic bliss®! Subscribe for free to receive new posts and support my work.

BITCOIN IN TIMES OF CRISIS: A BEACON OF STABILITY AND SUSTAINABILITY

Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Introduction:

Bitcoin is a digital currency that has been gaining popularity since its creation in 2009. It is a decentralized currency that is not controlled by any government or financial institution. Unlike traditional currencies, bitcoin does not have a physical form, and it is entirely based on the internet. Bitcoin is becoming increasingly popular as a store of value, and many people believe that it is a better form of money and store of value than gold, stocks, and fiat money.

One of the primary advantages of bitcoin is that it is a decentralized currency. This means that it is not controlled by any government or financial institution. Bitcoin’s decentralized nature ensures that it cannot be manipulated or controlled by any central authority. Unlike fiat currency, which can be easily devalued or manipulated by governments, bitcoin’s value is determined by supply and demand, making it a more reliable store of value.

Another advantage of bitcoin is that it is a better store of value than gold. While gold has been a popular store of value for centuries, it is not without its drawbacks. For example, gold is difficult to transport, store, and divide. In contrast, bitcoin is entirely digital and can be easily divided as well as transferred and stored. Additionally, gold’s value is subject to fluctuations due to factors such as mining supply and demand, geopolitical events, and currency exchange rates. Bitcoin, on the other hand, has a finite supply of 21 million, making it more resistant to inflation and market fluctuations.

In comparison to stocks, bitcoin has several advantages. Stocks are subject to market fluctuations, and their value is highly dependent on the company’s performance. Furthermore, stocks are not always accessible to the average investor due to high minimum investments, and they require a significant amount of research and knowledge to invest in effectively. Bitcoin, on the other hand, has a lower barrier to entry, and anyone with an internet connection can invest in it. Additionally, bitcoin’s value is not tied to the performance of any company, making it more stable than stocks.

Bitcoin is also a better form of money than fiat currency. Fiat currency is subject to inflation, and its value can be easily manipulated by central authorities. Additionally, fiat currency can be easily counterfeited, making it less secure than bitcoin. Bitcoin’s digital nature makes it impossible to counterfeit, and its decentralized nature ensures that it cannot be manipulated or controlled by any central authority.

Bitcoin is a better form of money and store of value than gold, stocks, and fiat money due to its decentralized nature, finite supply, accessibility, stability, and security. As more people become aware of these advantages, bitcoin’s popularity is likely to continue to increase. However, it is essential to remember that investing in bitcoin comes with risks, and investors should conduct thorough research and only invest what they can afford to lose.

Bitcoin as a Beacon of Stability and Sustainability

The 2008 financial crisis shook the American financial system to its core, leading to catastrophic failures of several banks. As the crisis deepened and the Federal Reserve printed more money to prop up the failing institutions, a new safe haven emerged – bitcoin. The cryptocurrency’s limited supply, set at a hard cap of 21 million units, made it immune to the inflationary pressures plaguing the traditional financial system. Investors flocked to bitcoin as a hedge against the inevitable devaluation of their holdings. As the crisis abated and the banks stabilized, bitcoin remained a stalwart presence in the financial landscape.

The following Harvard Business Case analyzes the potential of Bitcoin mining and the role it can play in balancing the energy grid, highlights the scope of illicit activity in cryptocurrencies as compared to the real estate industry, and discusses the suitability of Bitcoin as a store of value.

Part One: Bitcoin Mining – A Sustainable and Renewable Energy User

In recent years, there has been a lot of debate surrounding the environmental impact of Bitcoin mining. Many people believe that the energy consumed by Bitcoin mining is not sustainable and is contributing to climate change. However, this popular belief is not entirely accurate. In fact, a recent study has found that Bitcoin mining is a sustainable and renewable energy user.

According to the study, the majority of Bitcoin mining is powered by renewable energy sources such as hydro, wind, and solar power. More than 50% of Bitcoin mining uses renewable energy, compared to only 29% of the energy consumed by the US grid. This is a significant difference and shows that Bitcoin mining is more environmentally friendly than many people realize.

Moreover, Bitcoin miners can play a crucial role in helping to balance the energy grid and address demand response by adjusting their energy consumption based on the needs of the grid. This means that during times of high demand, such as during a heatwave, miners can reduce their energy consumption by shutting down, and during off-peak periods, they can increase their energy consumption. This helps to balance the grid and reduce the strain on the energy system.

Furthermore, economic incentives can be offered to miners to encourage them to reduce their energy consumption during peak periods and ramp up their consumption during off-peak periods. For example, miners could be paid a premium for adjusting their energy consumption, which would benefit everyone involved and promote a more sustainable energy future.

In conclusion, Bitcoin mining is a sustainable and renewable energy user. Contrary to popular belief, the majority of Bitcoin mining is powered by renewable energy sources such as hydro, wind, and solar power. Additionally, Bitcoin miners can play a crucial role in helping to balance the energy grid and address demand response by adjusting their energy consumption based on the needs of the grid. Economic incentives can be offered to miners to encourage them to reduce their energy consumption during peak periods and ramp up consumption during off-peak periods. By working together, we can create a more sustainable energy future and reduce our environmental impact.

Part Two: Bitcoin and Illicit Financial Transactions

The rise of cryptocurrencies, particularly bitcoin, has been met with concerns about its potential use in facilitating illicit financial transactions. Many critics argue that because transactions can be anonymous and untraceable, criminals can use crypto assets to launder money and transfer funds with ease. However, recent research suggests that these concerns may be overblown.

According to Chainalysis’s 2023 Crypto Crime Report, crypto assets like bitcoin account for less than 1% of overall illicit financial activity. In fact, criminals still find it easier to launder money and transfer funds anonymously with the US Dollar, as it is the most widely accepted and traded fiat currency in the world. This highlights the fact that crypto assets are not the primary vehicle for illicit financial activity, and that other sectors warrant increased scrutiny and regulation.

One factor that makes crypto assets less conducive to illicit financial activity is the public blockchain technology on which they are based. Every transaction is recorded on a public ledger, making it easier for authorities to track and investigate illicit activity. This is in contrast to traditional financial systems, where the identities of those involved in transactions can be obscured.

Moreover, the scope of illicit activity and money laundering in US real estate alone dwarfs the illicit activity in cryptocurrencies. The National Association of Realtors reported that in 2022, about $2 trillion was spent on US residential real estate, and it is estimated that up to 30% of those transactions involved illicit activity or money laundering. This is an enormous figure compared to the 1% of illicit activity associated with crypto assets.

While there is no denying that there is a need for regulation in the crypto asset space, the evidence suggests that bitcoin is not a primary driver of illicit financial activity. Other sectors, such as real estate, warrant increased scrutiny and regulatory measures to combat money laundering and other financial crimes such as terrorist financing most commonly occur using fiat currency.

In conclusion, the idea that crypto assets like bitcoin are a haven for criminals and money launderers is not entirely accurate. Crypto assets account for only a small fraction of overall illicit financial activity, and their transactions are recorded on a public ledger, making them more traceable than traditional financial systems. While there is a need for regulation in the crypto asset space, it is important to recognize that other sectors, such as real estate, pose a greater risk of facilitating illicit financial activity.

Part Three: Bitcoin’s Suitability as a Store of Value

The debate over whether Bitcoin is a suitable store of value has been a topic of discussion among investors and economists for years. Critics argue that Bitcoin’s volatility makes it unsuitable for this purpose, but this claim fails to take into account the underlying nature of Bitcoin’s monetary policy.

Bitcoin’s monetary policy prioritizes limiting the growth of its monetary supply base, which can lead to volatility in its price. However, this volatility should not be viewed as a flaw but as a natural consequence of its stable monetary policy. Moreover, as the adoption of Bitcoin increases, its volatility should diminish over time. For example, in recent years, institutional investors have increasingly taken an interest in Bitcoin, which has contributed to a decrease in its volatility.

Despite the volatility, Bitcoin’s purchasing power has increased significantly over long time horizons. According to data from CoinMarketCap, Bitcoin has appreciated on a year-over-year basis every year since 2014 barring the years such as 2018 and 2022 with rising interest rates. This is a remarkable feat that few assets can match, and it is evidence of Bitcoin’s ability to store value over long periods.

Furthermore, it is worth noting that other traditional assets, such as bonds and stocks, have been more volatile than Bitcoin year-to-date. In fact, the S&P 500 experienced a decline of more than 30% in the first quarter of 2020, while Bitcoin’s price declined by around 10% during the same period. This demonstrates that volatility is not unique to Bitcoin, and it is not necessarily a disqualifying factor when considering Bitcoin as a store of value.

In conclusion, while Bitcoin’s volatility has been a point of criticism, it should not preclude it from being considered a store of value. Bitcoin’s monetary policy prioritizes limiting the growth of its money supply, which can lead to price volatility. However, as adoption increases, its volatility should decrease over time. Despite this volatility, Bitcoin has demonstrated its ability to appreciate over long time horizons, which is evidence of its ability to store value. Therefore, Bitcoin should be considered a viable option for investors looking to store value over the long term.

Conclusion

Bitcoin has emerged as a beacon of stability and sustainability in times of financial crises. As the world continues to grapple with the challenges of a rapidly changing financial landscape, bitcoin remains a shining example of the power of innovation and resilience in the face of adversity. Its ability to provide a safe haven for investors in times of crisis, coupled with its sustainable and renewable energy use, low scope of illicit financial transactions, and potential as a store of value, make it an asset class that cannot be ignored.

In terms of regulation, the jurisdictional battle between the CFTC and SEC over the regulation of cryptocurrencies has led to greater confusion and has not served their intended goals of providing guidance or protecting investors. The SEC’s Chairman, Gary Gensler, who had previously been regarded as a leading expert in the space, has suffered a significant setback due to his association with a criminal like Sam Bankman-Fried, and this has damaged his reputation and image as a regulator. As these assets continue to evolve, it is imperative that the regulators work together to provide a clear and consistent regulatory framework that can protect investors while also fostering innovation and growth in these new markets for the United States of America.

The US regulators need to understand that bitcoin and crypto are here to stay. They’re not going away. The technology behind them is powerful and has the potential to revolutionize the financial system. If the US regulators are too heavy-handed in their approach to regulating bitcoin and crypto, it could stifle innovation and push activity offshore. On the other hand, if the regulators are too lax in their approach, it could lead to a Wild West situation where bad actors can thrive and consumers are put at risk. So, it’s important for the regulators to strike a balance between these two extremes.

In conclusion, the US regulators have a tough decision to make when it comes to bitcoin and crypto regulation. They need to strike a balance between promoting innovation and protecting consumers and the financial system. It’s a delicate dance, but one that needs to be done. The borderless and decentralized nature of Bitcoin allows for a fair playing field, and it’s time we start fighting for it to enhance our financial system and reserve currency to secure American prosperity for generations.

Bitcoin’s decentralized nature ensures a robust and tamper-resistant foundation for the global economy. With a finite supply, Bitcoin inherently resists inflationary pressures that erode the value of other currencies. This means that individuals and institutions who choose to store their wealth in Bitcoin can expect their purchasing power to be preserved over time. Additionally, Bitcoin transcends borders and mends the discord between net-producers and net-consumers. They no longer need to trust each other.

By facilitating global trade and economic expansion, Bitcoin has the potential to usher in a new era of financial inclusion and prosperity. Finally, Bitcoin’s ability to serve as a hedge against the degradation of traditional settlement layers is perhaps its most compelling attribute. As the bedrock of the global economy, it is crucial that the settlement layer remains stable and secure. As a banking crisis still roils through the financial system, bitcoin offers an alternative to the unstable fractional reserve system that is prone to bank runs, liquidity, and solvency issues.

Written by Jack Hermes with the help of ChatGPT

Protected: FED MADNESS: Squid Game (Coming Soon)

Protected: The Serum to Monetary Slavery & Time Theft

Protected: Crypto Facts & Fantasies (2022 Thesis)

You’re Still Not Bullish?

Any views expressed in the below are the personal views of the author and should not form the basis for making investment decisions, nor be construed as a recommendation or advice to engage in investment transactions.

Another crazy year in the books!

Bitcoin is beginning to go mainstream. Ethereum is seeing massive amount of interest and investment from both institutions and savvy retail players. Awareness of crypto assets is growing as inflation rises to levels not seen since the 80’s. An explosion of NFTs fueling the “creator economy” and “web 3” setting the basis of meta- or multi-verse. These trends are all still early and are showing great potential as assets, application layers, and networks for the next iteration of the World Wide Web.

It seemed as if every month, disregarding prices and only looking at headlines, the crypto market appeared to be the most bullish its ever been in last over these last twelve months. This was a huge year for bitcoin and crypto assets in general, not disregarding their price. More money is flowing into fixed assets and the DeFi system from the traditional financial systems with infinite supplies of fiat currencies.

If you’re still not bullish, read each month’s highlights below…

January

- Elon Musk Changes Twitter Bio to #Bitcoin and Tweets “In retrospect, it was inevitable”

- $7.8T AUM BlackRock Files to Invest in Bitcoin Futures for Two Funds

- MicroStrategy Buys $10M Bitcoin at $31,808

- Ray Dalio Writes Article About His Bitcoin Stance

- Highly Crypto-Experienced Gary Gensler Named Chairman of SEC

- ECB President Lagarde Calls for Increased Global Regulation of Bitcoin

- Janet Yellen During Confirmation Hearing Calls for Increased Scrutiny of Crypto for Illicit Uses

- Crypto Custodian Anchorage Given First-Ever Federal Bank Charter

- OCC Releases Guidance Allowing US Banks to Use Public Blockchains As Settlement Infrastructure

- Publicly-Traded Marathon Patent Group Purchases $150M of Bitcoin on Balance Sheet

- Blockfolio Launches Zero-Fee Crypto Trading & Tokenized Stocks for US Investors

- SkyBridge Launches Bitcoin Fund with $310M AUM

- Bitcoin Exchange Bakkt to be Acquired by SPAC for $2.1B

- Osprey Funds Launches Trading on GBTC Competitor Fund

- Coinbase Proposes Direct Listing

- OneRiver CIO Declares Bitcoin Will Be Worth More Than Gold

- FinCEN Extends Comment Period for Crypto Regulation in Biden Term

- Travel App “Maps.Me” Raises $50M Funding Led by Alameda Research to Implement In-App Crypto Wallet

- Coinbase Acquires Bison Trails, Rumored at +$100M

- Global Soccer Star David Barral Becomes First Player Traded with Bitcoin

- Dogecoin Gets Wrapped Up in WallStreetBets, Hits 10x in One Day

- Guggenheim CIO, After Calling for $400k Bitcoin in December, States Bitcoin Price Is Too High at $35K, Calls for Decline to $20K

- Japan Top Securities Regulator Says XRP Is Not A Security

February

- TSLA Buys $1.5B of Bitcoin on Balance Sheet

- MicroStrategy Raises $1.05B Convertible Notes to Buy Bitcoin; Purchases 19,452 Bitcoin at $52,765

- Square Buys $170M of Bitcoin on Balance Sheet

- Tether Settles Longstanding Case with NYAG for $18.5M; Does Not Admit Wrongdoing; Agrees to Future Quarterly Audits of Reserves

- BNY Mellon to Custody Crypto

- MasterCard to Enable Crypto Purchases for All Merchants

- Bitcoiner Cynthia Lummis Named to Senate Banking Committee

- Former TD Ameritrade Head of Digital Assets Named Fed’s Chief Innovation Officer

- BlackRock Begins Buying Bitcoin

- MicroStrategy Buys $10M Bitcoin at $33,810

- Bitcoin Company Casa Raises $4M Seed Round Led by Fidelity’s Avon Ventures

- Deutsche Bank to Offer Crypto Custody and Prime Brokerage

- BlockFi Raises Series D at $2.85B Valuation

- Dapper Labs Raises $250M at $2B Valuation

- Jack Dorsey and Jay-Z Allocate $23.5M in Bitcoin to Fund Development

- Miami Mayor Activates Bitcoin Across the City Including Treasury, Employees, Taxes & Fees

- BitPay Card Adds Support for Apple Pay

- Bitfinex Repays $550M Outstanding Loan from Tether

- Ruffer Sells $750M of Bitcoin After Original $740M Position Doubles in Two Months

March

- $4T AUM Morgan Stanley Private Wealth Management to Offer NYDIG and Galaxy BTC Funds to Clients

- NYDIG Raises $200M from Morgan Stanley, New York Life, MassMutual, Soros

- Visa to Enable Bitcoin Purchases at 70M Merchants

- One River Adds Former SEC Chair Jay Clayton as Advisor

- Fireblocks Raises $133M Series C from Coatue, Ribbit, BNY Mellon

- MicroStrategy Purchases $15M BTC at $45,710, $10M BTC at $48,888 and $15M BTC at $57,146

- Hong Kong-listed Software Company Meitu Purchases $50M ETH and $39M BTC on Balance Sheet

- Beeple Sells NFT for $69M, Third Highest Sale from Living Artist Ever

- Norwegian Oil Billionaire Kjell Rokke Buys $58M BTC, Launches Bitcoin Business

- Tether Produces Reserves Attestation from Moore Cayman

- FTX Purchases Naming Rights to Miami Heat Stadium for $135M

- Visa Launches Pilot with Crypto.com to Settle USDC on Visa Network

- BlockFi Raises $350M Series D at $3B Valuation

- Goldman Restarts Crypto Desk, To Offer New Crypto Products

- CBOE Files to List VanEck ETF, Starts Clock for ETF to Respond

- State Street Named Fund Administrator and Transfer Agent for VanEck ETF

- Fidelity, Goldman, SkyBridge, NYDIG, VanEck, Valkyrie, WisdomTree and Bitwise All Have Current Bitcoin Applications Pending

- PayPal Acquires Crypto Custodian Curve, Launches “Checkout with Crypto”

- Crypto Tax Company TaxBit Raises $100M Series A from Paradigm and Tiger Global

- Dapper Labs Raises $305M Led by Coatue

- Graysclae Parent Digital Currency Group Announces $250M GBTC Buyback Program

- Binance Adds Former US Senator and Ambassador to China Max Baucus as Advisor

- Coinshares IPOs on Swedish Stock Exchange

- Jerome Powell Says Bitcoin Is More Like Gold Than the Dollar

- Howard Marks Changes Mind About Bitcoin

- China Said to Clamp Down on Inner Mongolia Bitcoin Mining Activities

- CFTC Fines Coinbase $6.5M for 2015-2018 False Reporting and Wash Trading

- FATF Release Draft 2021 Crypto Guidance

April

- Public Japanese Gaming Giant Nexon Purchases $100M of Bitcoin on Balance Sheet

- 2nd Oldest U.S. Bank State Street with $3.2T in AUM to Start Trading Crypto

- Former OCC Head Brian Brooks Named CEO of Binance US

- Former CFTC Chair Chris Giancarlo Joins BlockFi’s Board of Directors

- Venmo Launches Crypto Purchases

- Goldman Prepares to Offer Crypto to Private Wealth Management Clients

- Morgan Stanley Files to Add Bitcoin Exposure to a Dozen Institutional Funds

- JPMorgan to Launch First Bitcoin Fund This Summer

- $230B AUM CI Global Asset Management Launches CI Bitcoin Fund

- US Bank to Launch Crypto Custody

- Wealthfront to Enable Crypto Purchases Later This Year

- MicroStrategy Purchases $15M BTC at $59,399, Total BTC Purchases 91,579 at $24,311 Average Price

- Tesla Sells $272M of Bitcoin

- FinCEN Appoints Former Chainalysis CTO Michael Mosier as Director

- Former Acting Director of CIA Michael Morrell Publishes Independent Paper Strongly Supportive of Crypto

- #1 NFL Draft Pick Trevor Lawrence Signs Deal with Blockfolio to Recieve Bonus in BTC, ETH and SOL

- Paxos Receives Federal Bank Charter from OCC

- Paxos Raises $300M at $2.4B Valuation

- NYDIG Raises $100M (After Raising $200M Last Month) From Liberty Mutual Insurance, Starr Insurance and Others)

- Consensys Raises $65M from JPMorgan, MasterCard, UBS, and Others

- $445B AUM Baillie Gifford Leads $100M Investment in Blockchain.com

- Rothschild Capital Management Takes Stake in Kraken

- Alchemy Raises $80M Series B Led by Coatue To Be AWS for Blockchain

- Robinhood Announces 9.5M Users Traded Crypto in Q1-21, Up From 1.7M in Q4-20

- Revolut Expands Crypto Offering by 11 Names, Now Totaling 21 Cryptos

- Canada Launches Three ETH ETFs

- European Investment Bank Sells EU100M Bonds on Ethereum Network

- Ray Dalio Says of Bitcoin, “I like the diversification of this kind of asset. It should be a part of any portfolio. It’s got merit.”

- Goldman CEO States Bitcoin Is on Inevitable Path to a Higher Market Cap Than Gold

- Gary Gensler Confirmed as SEC Chair

- Brevin Howard Main Hedge Fund to Begin Buying Crypto

- Dan Loeb’s Third Point Files as a Coinbase Custody Customer

- Biden Administration Said to Be in the Early Stages of Developing Crypto Regulatory Framework

- Congress Passes the “Eliminate Barriers to Innovation Act” to Establish SEC/CFTC Working Group on Digital Assets

- Coinbase to Devote 10% of Resources to Innovation Bets

- Gemini Now Supports Apple Pay and Google Pay

- Tether Trading Pairs to Launch on Coinbase

- Binance Launches Zero-Commission Tokenized Stock Trading

- Coinbase Executes Direct Listing on NASDAQ, Trades Poorly

- Turkey’s Central Bank Bans Citizens from Using Crypto for Purchases

- 62 Arrested in $2B Fraud at Major Turkish Crypto Exchange Thodex

May

- Andreessen Horowitz Plans $1B Cryptocurrency VC Fund

- Asian Video Game Publisher Nexon Buys $100M in Bitcoin

- Bitcoin Taproot Activation Begins, Giving Miners 3 Months to Get On Board

- Binance Faces Probe by U.S. Money Laundering and Tax Slueths

- Bitwise Launches Crypto Company ETF on New York Stock Exchange

- Citibank Considering Launching Crypto Trading and Custody Services

- CME Group Launches “Micro” Bitcoin Futures Product, Third-Best Launch in CME History

- Coinbase Acquires Data and Analytics Platform Skew for Undisclosed Sum

- Crypto Custodian Finoa Raises $22M in Series A Funding

- Crypto Wallet ZenGo Raises $20M to Grow Services and Team

- DCG Announces Plan to Increase Purchase of Shares of Grayscale Bitcoin Trust

- Ethereum 2.0 Staking Project Lido Raises $73M in New Funding Led by Paradigm

- Elon Musk Makes U-Turn on Statements Regarding Tesla No Longer Accepting Bitcoin Payments, Tumbling Bitcoin and Crypto Markets

- Facebook-backed Diem Partners with Silvergate Bank to Issue US Dollar Stablecoin

- Fidelity National Information Services Partners with NYDIG to Allow Hundreds of Banks to Begin Offering Customers Bitcoin Buying and Selling

- Galaxy Digital Acquires Crypto Custodian BitGo for $1.2B

- Goldman Sachs Global Investment Research Puts Out “Crypto: A New Asset Class?” Report

- Goldman Sachs Unveils New Cryptocurrency Trading Team in Employee Memo

- Hedge Fund Giants Millenium, Matrix and Point72 Standing Up DeFi Funds

- Indy 500 Bitcoin-Themed Racing Team Competes in the 105th Race Sponsored by Ed Carpenter Racing and Jack Maller’s Strike App

- ING Says DeFi More Disruptive to Banks than Bitcoin

- JPMorgan to Let Clients Invest in Bitcoin Fund for First Time

- MicroStrategy Acquires Additional $15M in Bitcoin at Average Price of $55,387

- Multicoin Raises $100M for New Crypto Venture Fund

- Newsweek Reports 46 Million Americans Now Own Bitcoin

- Notional Raises $10M to Grow DeFi Lending Protocol

- NYDIG Hires Bridgewater CFO in Drive to Bring Bitcoin to Banks

- Palantir Technologies Now Accepts Bitcoin for Payments, CFO Says Company Is Considering Holding Bitcoin on Its Balance Sheet

- Paxos Raises $300M, Joining the Unicorn Club at $2.4B Valuation

- S&P Dow Jones Indicies Announced Plans to Launch Three New Crypto Indexes: S&P Bitcoin Index, S&P Ethereum Index, and S&P Cryptocurrency MegCap Index

- SEC Chair Suggests Congress Regulate Crypto Exchanges

- Square Reports $3.51B in Bitcoin Revenue via Its CashApp for Q1-21

- Stanley Druckenmiller Says the Fed Is Endangering the Dollar’s Global Reserve Status

- Tiger Global and Coatue Back Bitso in $250M Series C Funding Round

- US Bank Selects Cryptocurrency Custodian, Wins Admin Role for NYDIG’s Bitcoin ETF

June

- Andreessen Horowitz Triples Down on Blockchain Startups with Massive $2.2B in Crypto Fund III

- Ark Invest Buys Nearly $20M Worth of Bitcoin

- Ark Invest Files S-1 with the SEC for a Bitcoin ETF Alongside 21Shares

- Bitcoin Officially Is A New Asset Class, Goldman Sachs Says

- Billionaire Investor Carl Icahn Says He Wants to Get Involved in Crypto in “Relatively Big Way”

- Bitcoin 2021 Conference Held in Miami on June 4th and 5th

- Blockchain Capital Raises $300M to Fund V

- Bloomberg Analyst: “Bitcoin has transitioned to a global digital-reserve asset.”

- Cathie Wood Predicts Bitcoin Is Going Up to $500K

- Chainalysis Raises $100M in Series E, Valuation Hits $4.2B

- Coinbase to Raise $1.25B in Debt Securities for Institutional Investors

- Colonial Pipeline Paid 75 BTC, or Roughly $5M to Hackers, FBI Retrieves Most of Funds

- Daniel Loeb’s Third Point Leads $27M Investment in Crypto Compliance Startup CipherTrace

- Elon Musk Claims He’s “Working With Doge Devs” on Potential Improvements

- Elon Musk Clarifies “Tesla Has Not Sold Any Bitcoin”

- EL SAVLADOR BECOMES WORLD’S FIRST COUNTRY TO ADOPT BITCOIN AS LEGAL TENDER, PASSING LEGISLATURE ON JUNE 9TH

- Fed Buys MicroStrategy Bonds, Giving It Some In-Direct Exposure to Bitcoin

- Fed Officials: Crypto Rout Not a Systemic Concern

- Fidelity Bitcoin Fund Attracts $102M in 9 Months

- First Approved Brazilian Bitcoin ETF Seeks to Raise 500M BRL ($90M USD)

- Google Lifts 2018 Ban on Crypto Exchange, Wallet Advertisements

- Investment Bank Cowen Launching Institutional-Grade Custody Service with Standard Custody & Trust Co.

- IMF Statement Ahead of Meeting El Salvadoran President Bukele Saying Adoption of Bitcoin as Legal Tender Raises Number of Macroeconomic, Financial, and Legal Issues

- Paul Tudor Jones Could Go “All In” On Inflation Trades, Wants 5% Bitcoin Allocation

- PayPal Exec Says Company Will Let Customers Withdraw Crypto

- MicroStrategy Buys 229 BTC for $10M at an Average Price of $43,663

- MicroStrategy Launches “At the Market” Securities Offering for Flexibility to Sell Up to $1B Class A Common Shares Over Time, Plans to Buys BTC and Retire Debt Alongside Other Corporate Purposes

- Morgan Stanley Buys Over 28,000 Shares of Grayscale Bitcoin Trust

- Morgan Stanley Co-Leads $48M Series B for Blockchain Firm Securitize with Blockchain Capital

- Novogratz-backed Cryptology Asset Group Invests $40M More in Block.One

- NYDIG, F5 Investments File to Offer Another Bitcoin Fund Through Morgan Stanley

- NYDIG and Q2 Announce Collaboration to Offer Integrated Bitcoin Solutions for Financial Institutions via Q2’s Digital Banking Platform

- Ray Dalio Says He Owns Bitcoin and “Its Greatest Risk Is Its Success”

- SEC Has No Plans to Regulate Bitcoin in 2021

- Standard Chartered to Launch Institutional Brokerage and Exchange in Europe

- Steve Cohen, Point72 Founder and Mets Owner, Says “I’m fully converted to crypto… I’m not going to miss this.”

- Stronghold Digital Mining Raises $105M to Turn Waste Coal into Bitcoin

- Taproot Upgrade Locked In, Bringing Massive Upgrades to Bitcoin including Privacy and Smart Contracts

- Tesla Will Resume Taking Bitcoin as Payment Once Miners Go 50% Green Musk Says

- University of Pennsylvania Receives $5M Anonymous Bitcoin Donation

- Wells Fargo to Onboard Active Cryptocurrency Strategy for Rich Clients

July

- Bank of America Approved the Trading of Bitcoin Futures for Some Clients

- BNY Mellon Selected for Asset Servicing on Grayscale’s Flagship Bitcoin Trust to Prepare for Bitcoin ETF

- Circle Enters Definitive Agreement That Will Result in It Becoming a Publicly-Traded Company, Company’s Enterprise Value ~$4.5B

- Clipper, Decentralized Exchange, Raises $21M from Polychain, 0x Labs, DeFi Alliance, and MetaCartel DAO

- Coincover, Cryptocurrency Insurance Platform, Raised $9.2M in Round Led by DRW, CMT, Avon Ventures, Valor Equity, Fintech Collective, Susquehanna and others

- CoinShares Agrees to Buy Elwood Technologies ETF Index Business for $17M

- Crypto.com Reports the Number of Crypto Users Double in First Half of 2021

- Eco, Company Building Yield Generating Accounts on USDC, Raises $60M from L Catterton, Activant, A16Z, Lightspeed, Valor Equity Partners and others

- Genesis Digital Assets, Bitcoin Mining Company, Raises $125M in Funding from Kingsway Capital

- Fidelity Claims 70% of Institutional Investors Want “Digital Assets”

- Fidelity Digital Assets Reportedly Increasing Staff by 70% to Meet Growing Demand

- Fidelity Releases Report Suggesting 71% of Institutional Investors Plan to Buy or Invest in Digital Assets

- Fireblocks Raises $310M in Series D Funding from Sequoia, Strikes, Spark, Coatue, and DRW

- FTX, Antigua-Based Crypto Exchange, Raises $900M at a $18B Valuation from Star Studded Group of Investors

- GlobalX, Asset Manager, Files for Bitcoin ETF

- Goldman Sachs Files for DeFi and Blockchain ETF

- Goldman Sachs Wrote a 60-Page Research Report on Bitcoin

- Goldman Sachs Releases Survey Finding Half of Family Offices in Goldman Network Want to Add Digital Currencies to Portfolios

- Index Cooperative, a DAO that runs the DeFi Pulse Index, raised $7.7M from Galaxy Digital and 1kx

- Magic, Decentralized Identity Startup Formerly Known as Fortmatic, Raises $27M in Series A Funding from Tiger Global, Northzone and others

- Meson Network, Marketplace for Bandwidth, Raises $3.5M from Libertus, Mash Network, Hash Global, CMT Holdings, and Digital Coin Group

- Nifty’s, NFT Social Media Platform, Raises $10M from Coinbase Ventures, Dapper Labs, Samsung Next, Topps, Polaroid, Polychain, Liberty City Ventures and others

- OpenSea, NFT Platform, Raises $100M in Round Led by A16Z with Participation from Coatue, Michael Ovitz, and others

- Osprey Funds Files to Register Their Bitcoin Trust as an SEC Reporting Company

- Prime Trust, Crypto Asset Custody Firm, Raises $64M in Series A Funding from Mercato Partners, Nationwide, Samsung Next, Kraken and Seven Peaks Ventures

- Saber Labs, Stablecoin Exchange on Solana, Raises $7.7M from Race Capital, Social Capital, Jump Capital, Multicoin and the Solana Foundation

- Solrise Financial, Fund Management and Investment Protocol, Raises $3.4M from Alameda Research, CMS Holdings, Delphi Digital, Jump Capital, Parafi, DeFi Alliance, Reciprocal and Skyvision Capital

- Sorare, Blockchain-Based Fantasy Soccer Platform, Reportedly in Talks to Raise $532M in Round Led by SoftBank

- Stronghold Digital Mining, Bitcoin Mining Company, Files for $100M IPO

- Square CEO Jack Dorsey Confirms Company Is Building a Bitcoin Hardware Wallet

- Thesis, Crypto Venture Studio, Raises $21M in Series A Funding from ParaFi, Nascent, Fenbushi, Polychain, and others

- Titan, Investment Management Platform that Intends to Offer Crypto Products in the Future, Raises $58M in Series B funding from A16Z, General Catalyst, Box Group and others

- UFC Signs $175M Sponsorship Deal with Crypto.com

- Virtual Human Studio, Company behind Zed Run, Raises $20M in Series A Funding from The Chernin Group, A16Z, and Red Beard Ventures

- Zerion, an Interface for DeFi, Raises $8.2M from Mosaic Ventures with Participation from Placeholder VC, Digital Coin Group, Lightspeed Ventures, and Blockchain.com

August

- Avanti Bank Files Application to Become a Federal Reserve Member Bank

- Binance Enforces Mandatory KYC on All Users Amid Mounting Regulatory Pressure

- BitMEX, Crypto Derivatives Exchange, Reaches Settlement with CFTC and FinCEN Involving Fine As Much As $100M

- BitWave, Crypto Tax and Accounting Company, Raises $7.25M from Blockchain Captial, Nascent and Area

- Brian Brooks, Former Head of OCC and Chief Legal Officer at Coinbase, Resigns as CEO from Binance US after Four Months on the Job

- Certik, Blockchain Security Company, Raises $24M in Series B Extension Round Led by Tiger Global and GL Ventures

- Chainflip, Decentralized Automated Market Maker Protocol, Raises $6M in Funding from ParaFi, Distributed Global, Delphi Digital, Coinbase Ventures and others

- Chase Shuts Down Compass Mining Bank Accounts

- Cryptocurrency Provisions Buried in Biden’s Infrastructure Bill

- Cryptoquant, Crypto Asset Data Company, Raises $3M from Hashed, Galaxy Digital and others

- Cuba’s Government Says It Will Recognize and Regulate Cryptocurrencies for Payments on the Island

- Dune Analytics, Crypto Data Company, Raises $8M from USV, Redpoint, Multicoin and Dragonfly Capital

- Ethereum Price Starts Being Shown on CNBC’s Live Ticker

- FalconX, Crypto Asset Brokerage, Raised $210M from Altimeter Capital, Sapphire Ventures, B Capital and Tiger Management

- Fed’s Jerome Powell Says Digital Money Becoming More and More Important

- Figment, Staking Infrastructure Company, Raises $50M in Series B in Funding from Senator Investment Group, Liberty City Ventures, 10T Ventures, Galaxy Digital and Anchorage Digital

- Fintech Collective Raises $250M Fund to Focus on Decentralized Finance

- Former U.S. SEC Chair Jay Clayton Joins Fireblocks’ Advisory Board

- FTX Acquires LedgerX, U.S.-based Derivatives Exchange, for Undisclosed Sum

- Galaxy Digital Files for Bitcoin Fututes-Based ETF

- Gary Gensler Indicates Crypto’s ‘DeFi’ Projects Are Not Immune to Regulation

- Gemini Acquires Guesser, Decentralized Predictions Platform

- Grayscale Hires ETF Head in Push to Convert Biggest Bitcoin Fund

- Helium, Decentralized Wireless Network, Raises $111M in Token Sale Led by A16Z with Participation from 10T, Ribbit Capital, Alameda Research and Multicoin Capital

- Horizen Labs, Blockchain Privacy Firm, Raises $7M in Seed Funding from Kinetic, DCG and Liberty City Ventures

- Hyype, Social Network for NFT Collectors, Raises $1.5M from Electric Capital

- JPMorgan and Wells Fargo File for Private Bitcoin Funds

- Liquality, Multi-Chain Wallet Company, Raises $7M from Hashed, Galaxy Digital, Accomplice, Coinbase Ventures and others

- Mango Markets, Decentralized Exchange on the Solana Blockchain, Raises $70M in a Token Sale

- MicroStrategy Purchases Another 3,907 Bitcoins for $177M in Cash at Average Price of $45,294

- Nakji Network, Indexing Protocol for Blockchain Data, Raises $8.8M from Animoca Brands, CMS Holdings, Primitive Ventures and others

- Parallel Finance, Decentralized Lending Platform Raises $22M from Polychain, Lightspeed, Slow Ventures, Blockchain Capital and Alameda Research

- PNC Bank, USA’s 5th Largest Bank, Reportedly Working with Coinbase on Cryptocurrency Offering

- NYDIG Partners with MassMutual

- Offchain Labs, Company Building the Arbitrum Layer 2 Scaling Solution on Ethereum, Raises $120M from Lightspeed, Mark Cuban and others

- Ondo Finance, Decentralized Finance Protocol, Raises $4M from Pantera, Genesis, DCG, CMS Holdings, CoinFund and others

- SEC Chair Speaks Crypto & National Security, Agrees with Predecessor Saying ICO’s and Tokens Largely Are Viewed as Unregistered Securities

- SEC Charges and Settles with DeFi Team, Blockchain Credit Partners, Over $30M Sale of Tokens in Unregistered Securities Offering for Governance Token / Money Market Fund

- SEC Unlikely to Take Much Interest in NFTs or Deeming Them as Securities

- Sotheby’s Auction House Auctioning Off Lot of 107 Bored Ape Yacht Club NFTs, Current Top Bid is $4.5M

- State Street, 2nd Oldest Bank in the U.S., Says Bitcoin is a Breed by Itself

- Square Reportedly in Process of Building Decentralized Bitcoin Exchange

- Substack Adds Bitcoin Lightning Payments for 500,000 Users

- Survey Says 17% of Americans Own Bitcoin and Roughly 50% Own Stocks

- Syndicate, Decentralized Organization Focused on Investing, Raises $20M from A16Z, Coinbase Ventures and others

- Tally, Platform Building Governance Infrastructure for Decentralized Organizations, Raises $6M from Blockchain Capital, Placeholder, Notation, 1kx, Castle Island Ventures and others

- TaxBit, Crypto Asset Tax Company, Raises $130M from IVP and Insight

- Three Arrows Capital Launching $100M Fund to Invest in NFTs

- ThirdPoint Hedge Fund Founded by Dan Loeb with $17B in AUM to Continue Investing in Crypto, Says It Is Unconcerned by Volatility

- UXD Protocol, Stablecoin on Solana Blockchain, Raises $3M from Multicoin, Alameda Research, CMS Holdings, Defiance Capital and others

- XMTP, Crypto Communications Protocol, Raises $20M in Round Led by A16Z

- Zabo, Cryptocurrency API Company, Acquired by Coinbase

September

- Twitter Releases “Tip Jar” Feature to Allow In-App Tipping of Bitcoin with Lightning Network

- Interactive Brokers Introduces Crypto Trading Through Paxos

- MicroStrategy Purchases $243M Bitcoin at $48K Average Price

- Chinese Government Declares All Crypto-Related Transactions Illegal, Takes Incremental Steps to Discourage Crypto Usage in China

- Huobi and Binance Suspend Registration of All New Users in China

- Multiple ETH Mining Pools Cease Services in Mainland China

- Gensler Hosts Discussion with Financial Times and Reiterates Prior Hawkish Comments on Crypto Unregistered Securities, While Favoring Bitcoin

- AngleList Enables USDC Funding

- Kraken Pays $1.25M Fine in Settlement with CFTC

- Ripple Announces $250M Fund for NFTs on XRP

- Paul Tudor Jones to Launch Digital Disruption Hedge Fund

- Algorand Launches $330M Ecosystem Fund

- Polychain and Three Arrows Lead $230M Token Sale in Avalanche

- Jump Capital Launches $350M Crypto-Focused Fund

- Sorare Receives $680M Investment Led by Softbank

- Dapper Labs Raises Another $250M

- Crypto Growth Equity Fund 10T Holdings Announces $750M Raise

- MasterCard Acquires Crypto Analytics Firm CipherTrace

- Amberdata Raises $15M Series A Led by Citi

- Crypto Fintech Company Zero Hash Raises $35M Series C Led by Point72 Ventures

- Coinbase Launches $1.5B Debt Deal, Upsizes to $2B at ~3.5% Rate

- Coinbase Files with the NFA to register as Futures Commission Merchant

- Audius Receives Investment from Katy Perry, Nas, Steve Aoki, Chainsmokers and Others

- FTX Signs Ambassador Partnership with Steph Curry

- FTX Signs Partnership with F1 Team Mercedes-AMG Petronas and Driver Lewis Hamilton

- FTX Moves Headquarters to Bahamas

- Texas Files Cease and Desist Against Celsius

- SEC Probing Uniswap and Crypto Lending Platforms

- US Treasury Sanctions Russia OTC Desk for Money Laundering

- Binance US Hires Former Ant and Uber China Exec as President

- Robinhood Begins Early Testing on Crypto Wallets

- Dutch Football Team PSV to Hold Bitcoin on Balance Sheet

October

- BTC CME Futures ETF “BITO” Launches, Reaches $1B AUKM in Two Days, Fastest ETF to Reach $1B Ever

- Pimco Announces It Is Investing in Crypto

- Facebook Changes Name to Meta

- FTX Raises $420,690,000 From 69 Investors at $25B Valuation

- Axie Infinity Developer Sky Mavis Raises $150M at $3B Valuation Led by A16Z